Six tips to keep in mind in preparation for planting:

1. Transport Safely: Be

mindful as you transport equipment on public roadways. It is recommended to

provide the traveling public with many signs to warn them you’re moving more

slowly than they are. Newer equipment features a wide variety of warning

systems, such as flashing lights, extremity markings and slow-moving vehicle

signs. It is also recommended to bringing older equipment up to date to meet

modern standards.

2. Follow the Label:

When applying products like herbicide, pesticide, or fungicide, it is important

to read the label thoroughly. Do not overlook precautionary statements, such as

those urging you to wear long sleeves or protect your eyes. Keep a book of

product labels handy in case a chemical gets on your skin or in your lungs. Not

keen on keeping a book? Just snap photos of the label on your phone.

3. Maintain Equipment:

Keep every piece of equipment on your farm serviced. Even if you serviced a

machine before putting it away last season, that does not mean it will be in

perfect condition when you take it to the field this year.

4. Store Fuel Properly:

Store fuel away from your machine shed. If problems arise and a fire erupts,

keeping your fuel tank a safe distance away from buildings will offer the best

protection.

5. Stay Healthy:

Spending long hours in the field does not mean you should skip meals or rest.

Without an adequate amount of sleep and proper nutrition, you will be operating

at a reduced level in the fields. Follow the recommended guidelines for sleep

and diet. To stay well rested, the Centers

for Diease Control and Prevention

suggest between seven and nine hours of sleep per night for adults. To make

sure you’re eating right, use the U.S. Department of Agriculture MyPlate guide.

6. Watch for Children:

Large pieces of equipment that make a lot of noise will attract a child’s

attention. Avoid carrying your children on your farm equipment.

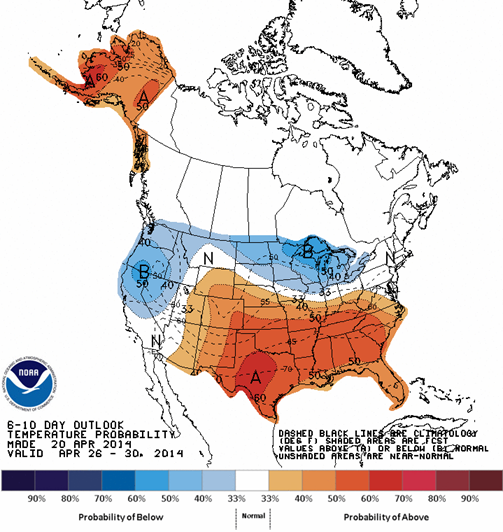

The corn and soybean markets were lower last night on little news. The 6-10 day weather forecast is starting to show above normal temperatures for the Midwest (mainly the southern belt) which could help get the U.S. Midwest back on the path to planting. The soybean market is feeling a little pressure thanks to fresh rumors of additional Brazilian beans heading to the U.S. I have said this before – these imports are needed and should be expected, but the bears in the market will still use this as a reason to sell.

The corn and soybean markets were lower last night on little news. The 6-10 day weather forecast is starting to show above normal temperatures for the Midwest (mainly the southern belt) which could help get the U.S. Midwest back on the path to planting. The soybean market is feeling a little pressure thanks to fresh rumors of additional Brazilian beans heading to the U.S. I have said this before – these imports are needed and should be expected, but the bears in the market will still use this as a reason to sell.